The 2026 housing market is already taking shape, and buyers and homeowners in Staten Island are asking one big question: Will it finally get easier to make a move?

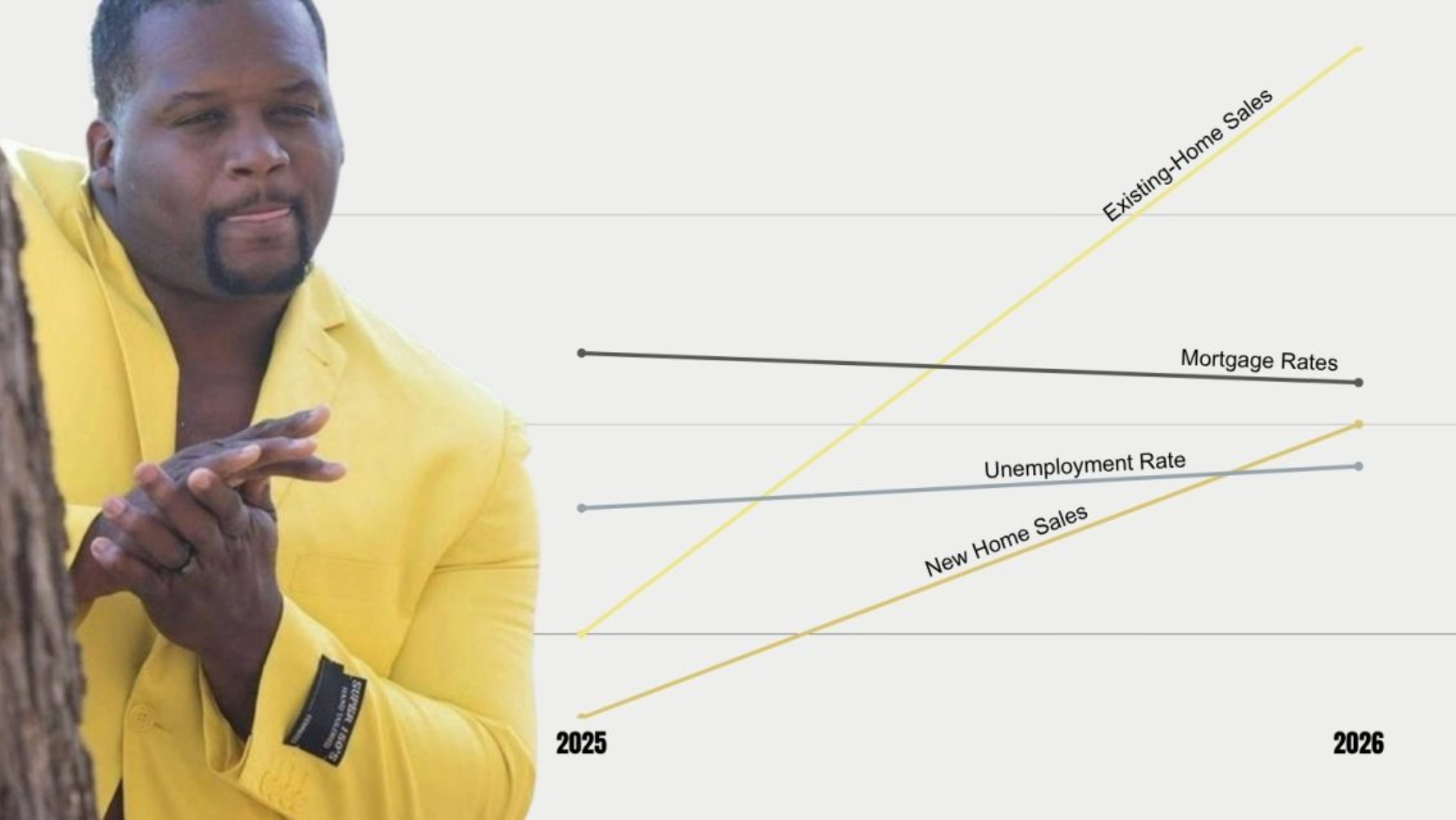

The latest national forecasts from the National Association of REALTORS® (NAR), Realtor.com, and Zillow point to a slow but meaningful improvement in housing market conditions.

We’re not looking at a dramatic reset. But it is a step toward balance.

Here’s what the experts expect, and how it could impact your plans for 2026.

Sales Activity: Slow Improvement, Not a Surge

All three forecasts show more home sales ahead nationwide in 2026 as affordability gradually improves, although their projections vary. Zillow expects the strongest growth, NAR sees a solid rebound and Realtor.com is more cautious but still trending upward.

National experts expect:

NAR: A 14% increase in home sales

Zillow: A 4.3% increase to about 4.26 million total sales, with pent-up demand releasing as more buyers return to the market

Realtor.com: A 1.7% increase in existing home sales to about 4.13 million.

Realtor.com’s more modest prediction stems from their expectation of persistent low turnover because four out of five homeowners have mortgage rates below 6%

In Staten Island, the pace of change may vary. Watching how quickly new listings go under contract is one of the clearest signals of shifting demand.

Home Prices: Still Rising, With a Bit More Relief

Prices are still expected to rise, although not at the breakneck pace of the pandemic. Waiting for a major price drop isn’t likely to pay off. For homeowners, continued equity growth is a major advantage.

National forecasts show:

More markets maintaining price stability as fewer cities see declines

Fewer large markets posting price drops: from 24 in 2025 to 12 in 2026 (Zillow)

Homeowners in Staten Island can still expect strong resale value, while buyers may find a little more negotiation power.

Mortgage Rates: Better Than 2025, Not Returning to 3%

All forecasts expect rates to hold above 6% in 2026, though comfortably below the early-2025 highs. Improving affordability should help more buyers get back into the game.

National experts expect:

A roughly 6.3% average mortgage rate in 2026 (Realtor.com)

Gradual improvement, but definitely no return to 3% rates (NAR and Zillow)

More buyers reentering the market as payments become more manageable (Zillow)

Granted, these forecasts don’t account for unexpected catastrophes (like a pandemic), which is why a return to 3% mortgage rates is not on the menu.

All that to say, if you’re buying in Staten Island in 2026, connecting with a lender early helps you understand what’s possible with your budget.

Inventory: More Choices, Still Below Normal

Supply’s growing again after years of record-low inventory. More homes coming to market benefits everyone. Buyers get more options and sellers get healthier demand.

National forecasts predict:

8.9% increase in existing home inventory

Months of supply averaging 4.6 months, pointing to a balanced market

Builders offering rate buydowns and incentives to keep new homes moving

In Staten Island, increased inventory may relieve some buyer competition, but standing out still matters when you’re making an offer.

Affordability: A Slow Shift in the Right Direction

For the first time in a while, affordability trends are moving toward buyers. It doesn’t mean housing will suddenly feel cheap, but it does mean more people can stay in the market.

National indicators show:

The typical payment share of income dropping to 29.3% in 2026, the first dip below 30% since 2022

More first-time buyers able to qualify as conditions ease

Rent affordability improving, helping renters save faster for a down payment

If you’re renting in Staten Island, this could be the window to start prepping for ownership.

What It Means If You Want to Buy

Small improvements add up when you are trying to secure your first or next home. Buyers in Staten Island can take advantage of:

Slightly lower borrowing costs

More homes to choose from

Less intense competition than the past few years

The most important move is to get a clear picture of your price range and timeline early. That gives you leverage when the right home hits the market.

What It Means If You Want to Sell

Sellers are still in a strong position. Prices are still rising and equity remains a powerful tool. But as buyers become more payment-sensitive, pricing strategy matters.

Sellers in Staten Island benefit from:

Strong resale values supported by demand

A growing pool of buyers who can now afford to move

Solid equity gains to put toward the next chapter

If a move better supports your lifestyle or finances, 2026 could be a smart time to take action.

Bottom Line

National forecasts signal that 2026 will be a more balanced and navigable housing market. And when it comes to buying or selling in Staten Island, planning ahead will help you make the most of improving affordability and increasing inventory.

If you want to explore your options and build a smart strategy for 2026, reach out anytime. I live for these strategy sessions, and I would love to help you get closer to your home-related goals for the coming year.

—

Joseph Ranola | Five-Star Staten Island & South Brooklyn Realtor® (30 + Google reviews)

Associate Broker · Matias Real Estate | Founder · Bridge & Boro Team

Serving 103xx and 11209 / 11214 / 11228 | $25 M + closed volume

📞 917-716-1496 | ranolarealestate.com