Imagine saving $150 a month on the same home, just because rates dropped.

That’s exactly what’s happening now, thanks to mortgage rates dropping to their lowest point in 11 months. That drop means homebuyers have more purchasing power today than they’ve had in nearly a year.

Let’s dive in.

What Happens When Mortgage Rates Drop?

Mortgage rates work like a price tag on your loan. When rates are high, borrowing money costs more each month. When they drop, even by a small percentage, your monthly payment shrinks.

That lower payment means one of two things:

You spend less each month for the same home.

You buy more home for the same monthly budget.

How Much Home Can You Afford?

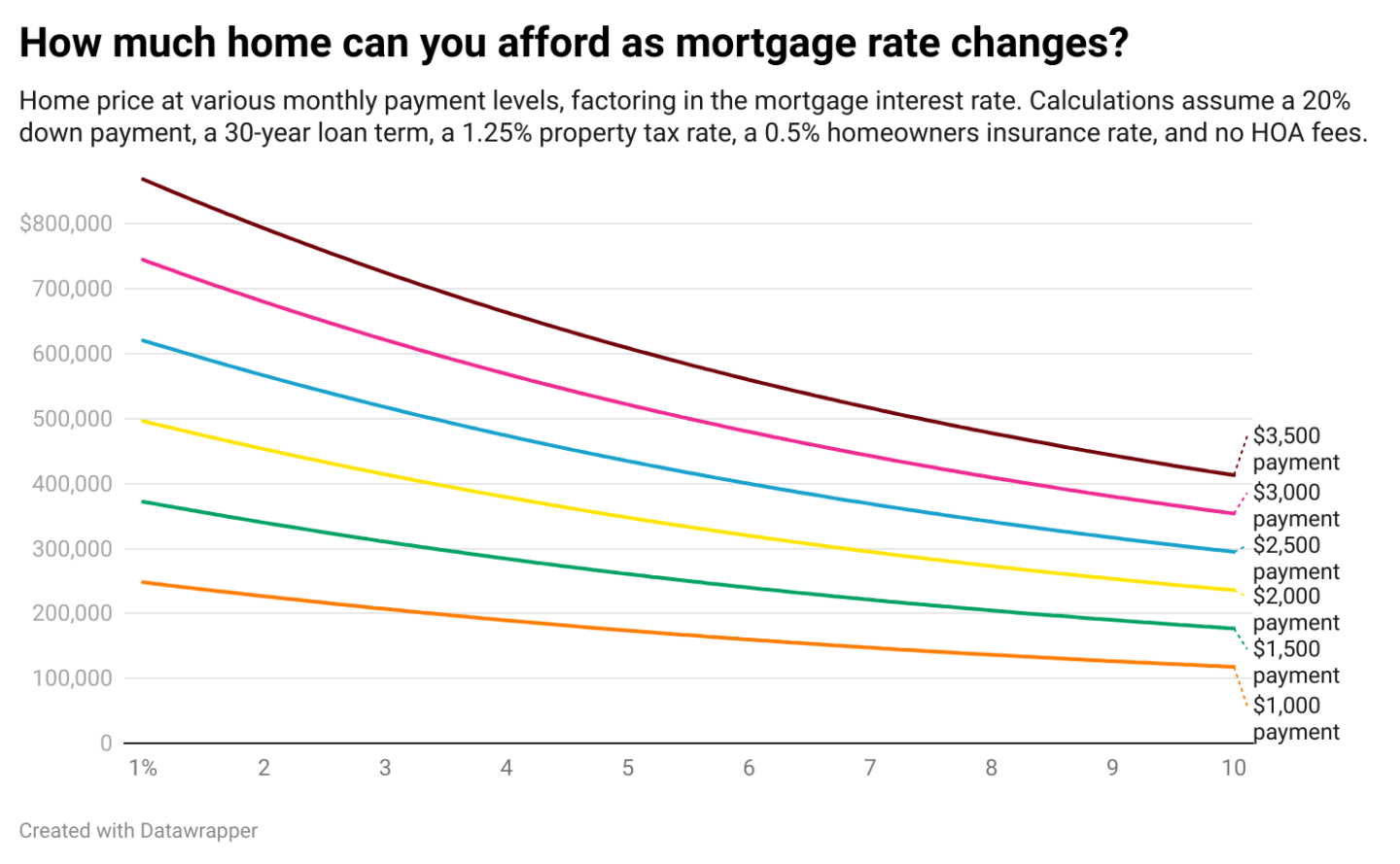

Let’s look at an example of a buyer with a $3,000 monthly housing budget.

In June, when rates averaged 6.9% a buyer could afford about $446,000, assuming a 20% down payment on a 30-year mortgage.

A couple of weeks ago, when rates were closer to 6.5%, that same buyer could afford a $460,500 home.

And now that rates have a new 2025 low of 6.27%? That buyer can afford a home worth $468,000.

In other words, buyers have gained $7,500 in purchasing power in the past week alone and a total of $22,000 in just three months.

Monthly Savings Add Up Fast

Here’s another way to look at this:

The median U.S. home costs about $444,000. In June, the monthly mortgage payment would have been about $2,624 for a median-priced home.

Today, the monthly mortgage payment for that home comes in at $2,481—a savings of roughly $150 every month. Over the life of a loan, that’s tens of thousands of dollars saved.

Those monthly savings on housing could help in a number of ways:

Building a “rainy day fund”

Paying off higher-interest debt more quickly

Investing for retirement

Saving for a vacation or a bucket list adventure

Saving for holiday spending (gifts, travel, decorating)

Is This Your Window?

Mortgage rates don’t typically fall this low without good reason. Recent economic data has shifted the outlook, and buyers are in a unique position.

Lower rates don’t just improve affordability; they also create new opportunities in the housing market.

—

Joseph Ranola | Five-Star Staten Island & South Brooklyn Realtor® (30 + Google reviews)

Associate Broker · Matias Real Estate | Founder · Bridge & Boro Team

Serving 103xx and 11209 / 11214 / 11228 | $25 M + closed volume

📞 917-716-1496 | RanolaRealEstate.com