For decades, buyers have been told to follow one simple rule:

Don’t spend more than 30% of your income on housing.

That is the gold standard. The budget benchmark. The line in the sand between “affordable” and “overextended.”

But in 2025, that line no longer seems attainable.

According to a Realtor.com® Affordability Report, the typical U.S. household would need to spend 44.6% of their income to buy a median-priced home today. And in cities like Los Angeles, that number jumps to over 100%.

So if you’re staring down home prices, crunching the numbers, and wondering why the math doesn’t add up anymore, you’re not alone. The old rulebook doesn’t work in this market.

But that doesn’t mean you’re stuck. It just means it’s time to budget differently.

What the 30% Rule Got Right (and What It Missed)

The 30% rule was never meant to be a law. It came from a 1969 housing policy called the Brooke Amendment, with capped public housing rent at 25% of a tenant’s income. In the early 1980s, that cap increased to 30%, and eventually became a go-to formula for financial advisors, mortgage lenders, and online calculators.

And for a while, it worked.

It helped buyers avoid overspending and left room for things like savings, emergencies, and daily life.

But here’s what it missed:

It doesn’t account for regional cost differences (a $1,200 mortgage hits differently in Tulsa vs. San Francisco).

It ignores existing debt, child care, or medical costs.

It assumes stable interest rates and steady home prices.

In today’s market, sticking to 30% can feel impossible. So instead of trying to squeeze your dream into an outdated formula, here’s a better approach.

How to Budget for a Home in 2025

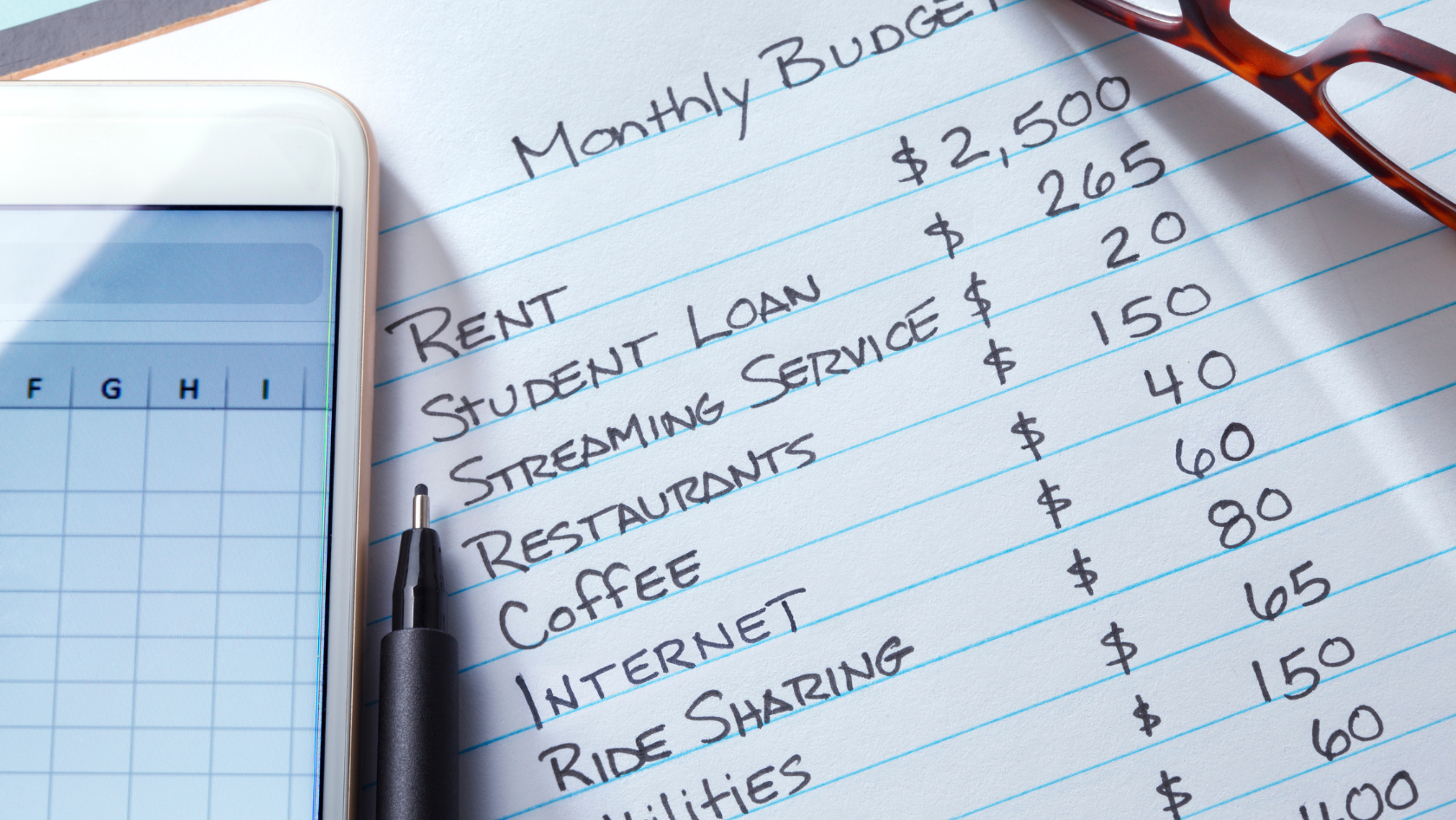

1. Start With Your Monthly Lifestyle Number

Forget percentages for a moment. Ask yourself:

How much are you comfortable spending each month on housing, while still living the life you want?

Look at your:

Current rent or mortgage

Other fixed expenses (car, insurance, groceries)

Debt and loan payments

Savings goals and emergency fund

Travel, hobbies, or childcare

The right number doesn’t have to be 30% of your income, but it does need to keep you financially stable, secure, and sane.

2. Understand the True Cost of Buying

When you see a home listed at $450,000, that’s not your monthly payment.

Here’s what you need to factor in:

Mortgage principal and interest

Property taxes

Homeowners insurance

PMI (if putting down less than 20%)

HOA fees (if applicable)

Maintenance and utilities

Online estimates can get you in the ballpark, but a lender can break it down line by line, even before you fall in love with a house.

3. Use the 30% Rule as a Red Flag

If your housing costs are hovering above 30%, it doesn’t automatically mean you’re in trouble, especially if you don't have a lot of debt outside of your monthly housing payments.

But if you’re creeping up toward 50% and also juggling credit card debt, student loans, or a variable income, that’s a red flag, and means you should pause and re-evaluate.

4. Get Strategic (and Local)

Affordability isn’t just about price. It’s about opportunity.

Here are a few levers that can shift the numbers in your favor:

Broaden your search area. A 15-minute drive can mean a 15% price drop.

Look at new construction. Builders may offer incentives that reduce monthly costs.

Ask about rate buydowns or creative financing. Sellers are becoming more motivated than in the past couple of years.

Focus on what you can comfortably afford now. Your first (or next) home doesn’t have to be your forever home.

The Bottom Line

The 30% rule might be outdated, but the goal behind it isn’t.

You still want a home you can comfortably afford. One that fits your lifestyle, not just your loan approval. And the good news? That’s still possible in 2025.

You just need a more personal approach.

If you’re trying to figure out how to make the numbers work, I’m here to help. Let’s take a real look at your budget, your goals, and the smartest next steps for you.

—

Joseph Ranola | Five-Star Staten Island & South Brooklyn Realtor® (30 + Google reviews)

Associate Broker · Matias Real Estate | Founder · Bridge & Boro Team

Serving 103xx and 11209 / 11214 / 11228 | $25 M + closed volume

📞 917-716-1496 | RanolaRealEstate.com

Request your free, data-driven home-value report →